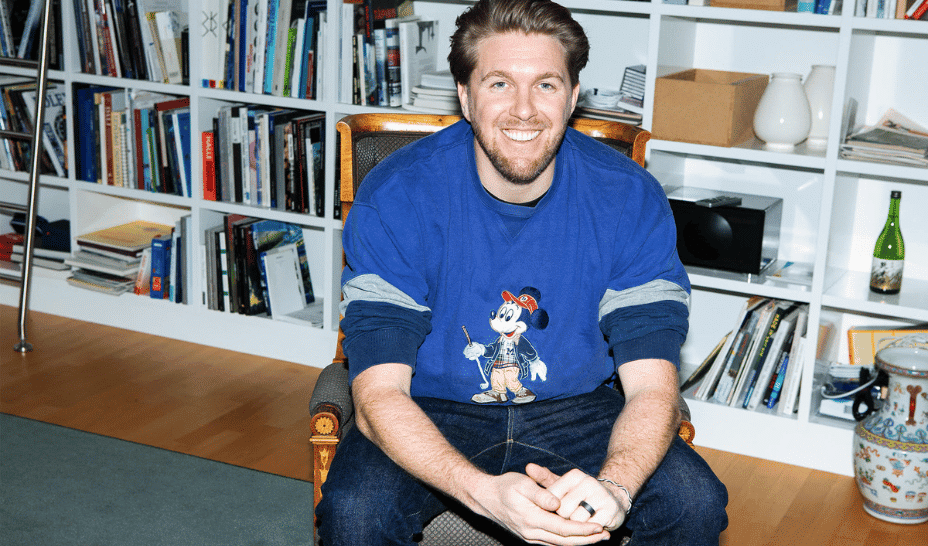

Robin Capital, a German solo GP-led venture fund founded by Robin Haak, has successfully closed its inaugural fund, Robin Fund One, raising a total of €15 million.

The fund, which includes €13 million in commitments alongside a €2 million growth-focused investment vehicle, focuses on supporting Pre-Seed and Seed-stage B2B SaaS startups in mid-market and Enterprise Go-to-Market sectors, with a particular emphasis on the DACH region.

Launched in December 2022, Robin Capital embodies nearly 15 years of Haak’s experience as a founder and investor.

Haak’s background includes roles as General Partner at Revaia (€250 million first-time fund) and co-founder of Jobspotting, acquired by SmartRecruiters (valued at €1.4 billion). He has been an early investor in notable companies like N26 and a growth investor in Aircall and Frontify.

Speaking about this achievement, Robin Haak shared, “Robin Capital is the product of my journey and a response to what I needed most throughout my career – a partner to guide founders from zero to IPO. This fund reflects that mission: supporting founders with expertise, networks, and authentic partnership.”

Robin Capital remains “intentionally small“, with ticket sizes ranging between €100–500k. Its specialty is in Pre-Seed and Seed-stage mid-market and Enterprise Go-to-Market companies in Europe and the DACH region.

Robin Fund One, which had its first close in June 2023 and final close in December 2024, is vertical-agnostic and spans a wide array of industries including HR, AI, Fintech, Climate, DevOps, Robotics, and Industrial Tech.

To date, the fund has deployed 55% of its capital, backing 28 portfolio companies such as Kombo, Phacets, and Xaver.

Backed by 70 Limited Partners, 95% of whom are seasoned professionals, the fund’s network includes General Partners from leading Private Equity and Venture Capital firms, fund-of-funds, and prominent founders and operators.

The fund leverages a network of nearly 100 operators from leading technology companies, providing critical support to its portfolio. Notable board appointments include:

- Eric Gelle, SVP Sales EMEA at iCIMS, is a board member of sustainability-focused startup and portfolio company – Spare It.

- Sarah Anderson Wilson, CHRO at Success Academy Charter Schools and former Chief People Officer at Rokt, is now a board member at HR startup and portfolio company – Bloom.

Robin Capital’s network also includes three accomplished Venture Partners:

- Renaud Visage, unicorn founder and former CTO of Eventbrite and current founder of Slate.VC, a €200M sustainability growth fund, advises portfolio companies on tech topics and offers the fund support with due diligence.

- Jerome Ternynck, unicorn founder of SmartRecruiters and founder of Rypples, a €20M sustainable fund investing in ocean conservation, brings product and Go-to-Market strategies expertise to our portfolio.

- Lea Vajnorsky, co-founder of Women Inc. and a leadership consultant at Russell Reynolds Associates, supports portfolio companies with HR and talent acquisition strategies.

For Haak, Robin Fund One represents just the beginning. “Robin Fund One is just beginning a lifelong mission for Robin Capital to support founders with capital, networks, and expertise. I wake up daily grateful to do what I love—serve founders.”

Leave a Reply